irs unveils federal income tax brackets for 2022

As of January 28 th the Internal Revenue Service IRS had 237 million returns awaiting action compared to a typical backlog at that point of roughly 1 million returns. Tax brackets for income earned in 2022.

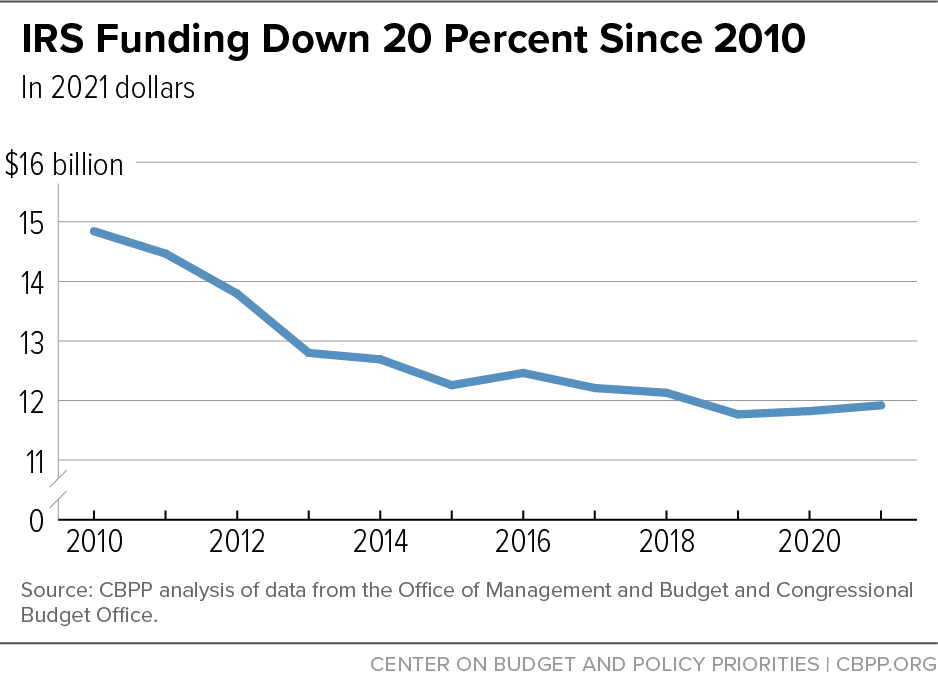

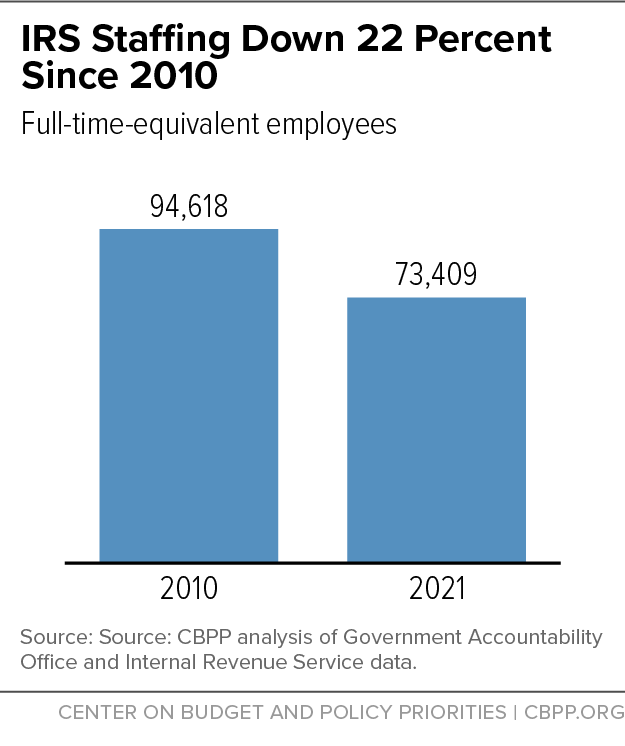

Congress Needs To Take Two Steps To Fund The Irs For The Short And Long Term Center On Budget And Policy Priorities

For most people tax rates were reduced.

. More guides on Finder. 2022 federal income. To understand which 2018 tax bracket you are in here are a few examples.

IRS unveils new federal income tax brackets for 2022. Your bracket depends on your taxable income. 15 Employers Tax Guide and Pub.

24 tax rate for 84201 to 160725. Tax law changes for 2022. You will pay 10 percent on taxable.

The 2021 tax rate ranges from 10 to 37. There are currently seven federal income tax brackets the IRS uses to calculate the percentage of peoples income that will go to taxes each year. Ron and Donna each have 150000 of taxable income in 2017 which is the year they got married.

77400 to 165000 22. 8 hours agoHeres an example of how tax bracket ranges can create a marriage penalty. You can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. 2022 federal income tax brackets. Irs Unveils Federal Income Tax Brackets.

2017 California Tax Tables Married Filing Jointly Review Home Decor from Read More. Since the 2018 tax year tax brackets have been set at 10 12 22 24 32 35 and 37. Its important to remember that moving up into a higher tax bracket does not mean that all of your income will be taxed at the.

In addition beginning in 2018 the tax rates and brackets for the unearned income of a child changed and were no longer affected by the tax situation of the childs parents. This publication supplements Pub. 10 tax rate for 0 to 9700.

2022 Tax Brackets Irs Married Filing Jointly. Use this tax bracket calculator to discover which bracket you fall in. The top marginal income tax rate of 37 percent will hit taxpayers with taxable.

Your 2021 Tax Bracket to See Whats Been Adjusted. The IRS has announced new federal income tax brackets for 2022. Social security and Medicare tax for 2022.

37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing jointly. IRS Unveils New Form for Senior Citizens How to calculate your required minimum distribution. It describes how to figure withholding using the Wage Bracket Method or Percentage Method describes the alternative methods for figuring withholding and provides the Tables for Withholding on Distributions of Indian Gaming Profits to Tribal Members.

There are seven federal income tax rates in 2022. In the coming days the IRS will announce the eight additional tax scams that round out the Dirty Dozen for 2022. 4 rows 2022 tax brackets for taxes due in april 2023 announced by the irs on november 10 2021.

The federal tax brackets are broken down into seven 7 taxable income groups based on your filing status. For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing jointly. Importantly your highest tax bracket doesnt reflect how much you pay in federal income taxes.

2022 Individual Income Tax Brackets. The tax rates for 2021 are. 8 rows in 2022 the income limits for all tax brackets and all filers will be adjusted for.

10 12 22 24 32 35 and 37. Single earning 100000 24. The IRS on Nov.

Both the Federal tax rate and income tax brackets changed beginning with tax year 2018 as part of. 10 of taxable income. Part of your income is taxed at each step and with each step the tax on your income increases.

In a press release IRS Commissioner Chuck Rettig warned that taxpayers should stop and think twice before including these questionable arrangements on their tax returns. File only one federal. For 2019 the tax brackets are as follows for single filers.

They dropped four percentage points and have a fairly significant amount of savings in taxes. The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. Single earning 190000 32.

51 Agricultural Employers Tax Guide. Discover Helpful Information and Resources on Taxes From AARP. When you figure how much income tax you want withheld from your pay and when you figure your estimated tax consider tax law changes effective in 2022.

Married filing jointly and earning 90000 22. Tax bracket Taxable income Taxes owed. Ad Compare Your 2022 Tax Bracket vs.

How much will you owe from papers and blogs. 10 12 22 24 32 35 and 37. For that tax year the 28.

The standard deduction increased over 3 for all filing statusAs was the case and. The IRS has announced higher federal income tax brackets for 2022 amid rising inflation. There are seven federal tax brackets for the 2021 tax year.

The tax rate increases as the level of taxable income increases. Being in a higher tax bracket doesnt mean all your income is taxed at that rate. 10 announced that it adjusted federal income tax brackets for the 2022 tax year meaning the changes will impact tax returns filed in 2023Wi.

Federal income tax rate table for the 2021 - 2022 filing season has seven income tax brackets with IRS tax rates of 10 12 22 24 32 35 and 37 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. If youre a single filer in the 22 percent tax bracket for 2022 you wont pay 22 percent on all your taxable income. November 12th 2021 under General News Law.

And the standard deduction is increasing to 25900 for married couples filing together and 12950 for. The seven tax rates themselves are unchanged but income limits for each bracket have been adjusted for inflation according to CNBC. See the latest tables below.

E-file tax software review. NW IR-6526 Washington DC 20224. Heres a breakdown of the seven tax brackets the IRS announced for tax year 2022.

22 tax rate for 39476 to 84200. Updated 2022 IRS Tax Brackets Final 2022 tax brackets have now been published by the IRS and as expected and projected federal tax brackets have expanded while federal tax rates stayed the same. Irs unveils federal income tax brackets for 2022 35 for incomes over 215950 431900 for married couples filing jointly 32 for incomes.

12 tax rate for 9701 to 39475. The United States Internal Revenue Service uses a tax bracket system. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

The rate of social security tax on taxable wages including qualified sick leave wages and qualified family leave wages paid in 2022 for leave taken after March 31 2021 and before October 1 2021 is.

Gig Workers Need To Get Ready For Tax Forms Protocol

Federal Income Tax Rates And Brackets And How Much You Ll Pay In 2022 Explained

2021 2022 Federal Income Tax Brackets And Rates

Irs Plans To Hire 10 000 Workers As It Grapples With Massive Backlog Of Tax Returns Ktla

2022 Tax Inflation Adjustments Released By Irs

Congress Needs To Take Two Steps To Fund The Irs For The Short And Long Term Center On Budget And Policy Priorities

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs To Pay 5 Percent Interest To Individuals With Delayed Tax Refunds Wane 15

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Tax Season 2022 10 Tax Breaks You May Be Overlooking

Democrats Unveil New Plan To Increase Taxes On Billionaires Pbs Newshour

Tax Rates Of America S Top Earners

2022 Tax Inflation Adjustments Released By Irs

What To Expect For Tax Refunds In 2022 Ciproud Com

The Irs Is In No Position To Do Your Taxes The Hill

Biden Unveils Billionaire Minimum Tax New Corporate Tax Rate Seeking Alpha

2022 Tax Inflation Adjustments Released By Irs

Congress Needs To Take Two Steps To Fund The Irs For The Short And Long Term Center On Budget And Policy Priorities