maryland student loan tax credit 2020

The Maryland student loan debt relief tax credit came in effect in July 2017 by the MHEC. Taxpayers in Maryland who have incurred significant student loan debt may be eligible for the Student Loan Debt Relief Tax Credit through the Maryland.

Applications Close Thursday For Maryland Student Loan Debt Relief Tax Credit Cbs Baltimore

If the credit is more than the taxes owed they will receive a tax refund for the.

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher Education Commission. ANNAPOLIS MDGovernor Larry Hogan and Maryland Higher Education.

2020 Maryland Statutes Tax - General Title 10 - Income Tax Subtitle 7 - Income Tax Credits Section 10-740 - Student Loan Debt Relief Tax Credit. Maryland Student Loan Tax Credit 2020. Maryland taxpayers who maintain Maryland residency for the 2022 tax year.

The tax credit is claimed on. The Maryland Higher Education Commissionmay request additional. The tax credit is claimed on the recipients Maryland income tax return when they file their Maryland taxes.

If the credit is more than the taxes owed they will receive a tax refund. To qualify for the Student Loan Debt Relief Tax Credit you must. Governor Hogan Announces 2019 Award of 9 Million in Tax Credits for Student Loan Debt.

Instructions are at the end of this application. From the last three years the state of the United States of America has allocated funds. The total amount of the credit claimed shall be recaptured if you dont use the credit for the repayment of the undergraduate student loan debt within 2 years.

To anyone who applied for the MHEC student loan debt relief tax credit for 2020 you may want to check your applicationaward status on the Maryland OneStop portal to see if you were. Tax Year 2020 Only. To help homeowners deal with large assessment increases on their principal residence state law has established the Homestead Property Tax Credit.

The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for. Maryland Student Loan Tax Credit 2020. Incurred at least 20000 in.

August 12 2020. Were eligible for in-state tuition. The Homestead Credit limits the increase.

The new stimulus bill signed on December 21 2020 extends the ability for employers to make tax-free student loan repayment contributions for employees until 2025. If the credit is more than the taxes you would otherwise owe you will receive a. This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit.

Maryland student loan debt relief tax credit program more than 9k marylanders will receive student loan tax credit. February 18 2020 842 AM. The tax credit is claimed on the recipients Maryland income tax return when they file their Maryland taxes.

File Maryland State Income Taxes for the 2019 year. Maryland student loan debt relief tax credit program more than 9k marylanders will receive student loan tax credit. Complete the Student Loan Debt Relief Tax Credit application.

2020 Maryland Statutes Tax - General Title 10 - Income Tax Subtitle 7 - Income Tax Credits Section 10-740 - Student Loan Debt Relief Tax Credit. Indicate if you have applied for a Maryland.

Applications Close Thursday For Maryland Student Loan Debt Relief Tax Credit

Around 9 000 Americans In Line For 9 Million In Additional Tax Credits Are You One Of The Lucky Ones The Us Sun

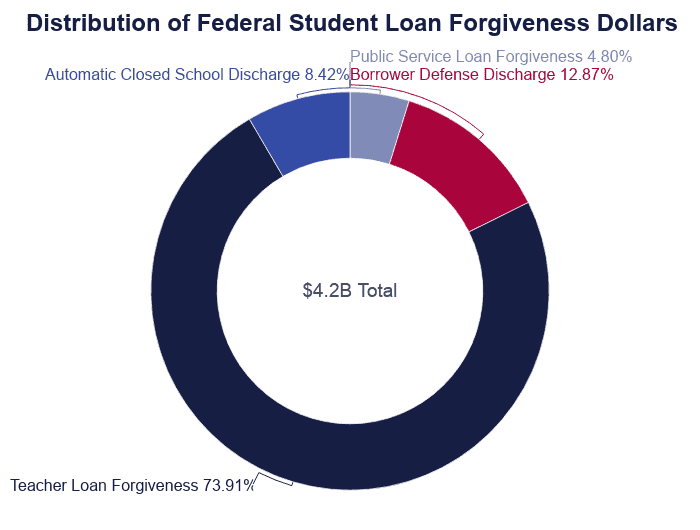

Student Loan Forgiveness Statistics 2022 Pslf Data

Maryland Home Loan Programs For Veterans

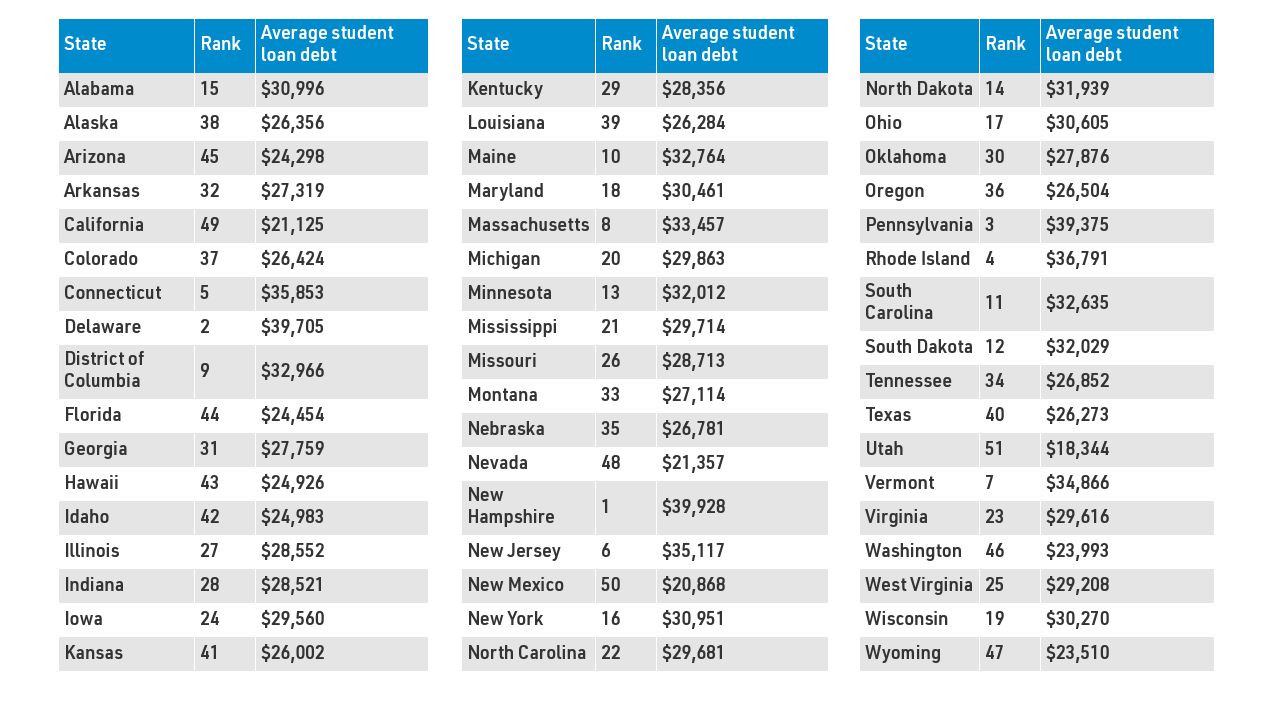

This Is The Average Student Loan Debt In Every State Fox Business

Maryland Paycheck Calculator Smartasset

Maryland Consumer Rights Coalition

Student Debt Relief For Eligible Marylanders Youtube

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/tronc/UCJ5TMGQ3ZDOROBM5EFGAPKW2A.jpg)

Maryland Graduates Have On Average 32 000 In Student Loan Debt Here S How To Stem The Crisis Commentary Baltimore Sun

Can I Get A Student Loan Tax Deduction The Turbotax Blog

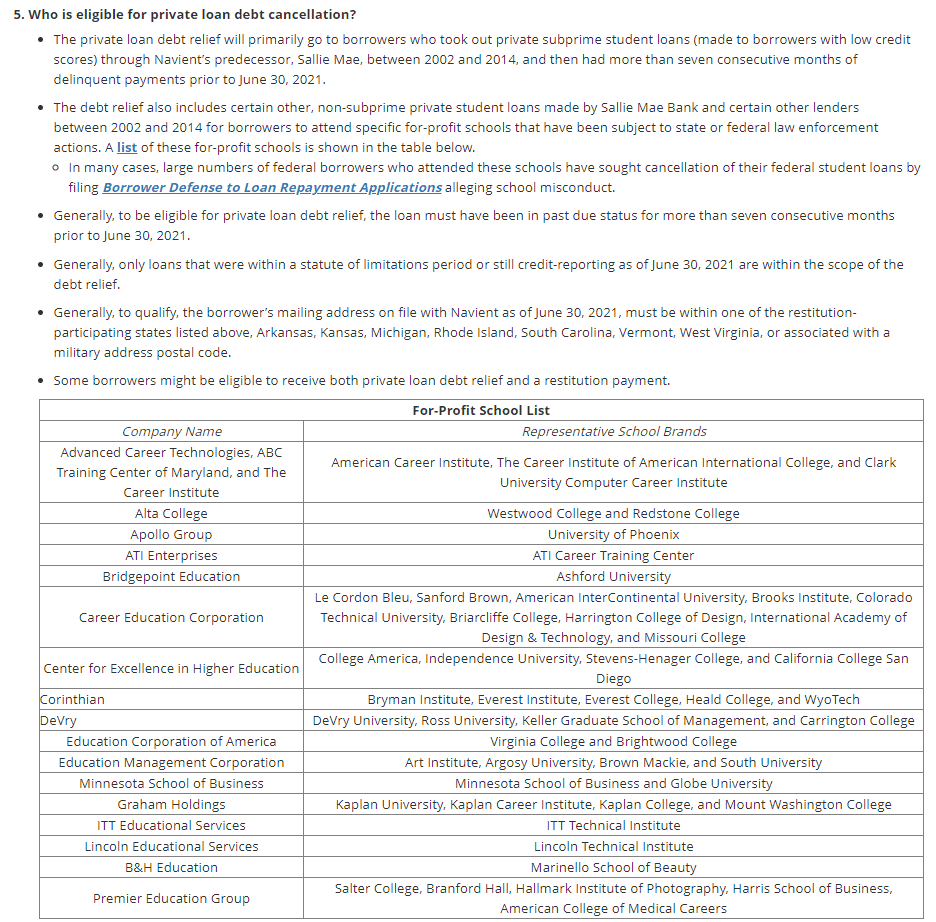

How To Get Navient Student Loan Forgiveness The Complete 2022 Guide

Maryland Student Loan Forgiveness Programs

Will Borrowers Have To Pay State Income Tax On Forgiven Student Loans Wolters Kluwer

Maryland State Tax Guide Kiplinger

Chart Where U S Student Debt Is Highest Lowest Statista

Student Loan Interest Deduction Md Tax

Maryland Student Loans Debt Statistics Student Loan Hero

State Taxes And Student Loan Forgiveness Ibr Pslf And More

Student Loan Borrowers In 7 States May Be Taxed On Their Debt Cancellation Npr